Do you want to learn how to write a check easily? Writing a check is still important, even in today’s digital world. Many people use checks for rent, bills, or payments. If you have never written a check before, don’t worry! It’s very simple.

In this guide, we will explain how to write a check step by step. You will learn what details to fill in and how to avoid common mistakes. By the end, you will feel confident whenever you need to write a check. Let’s get started!

Table of Contents

Why Do People Still Write Checks Today?

Even in the digital age, many people still use checks. Some landlords, businesses, and service providers prefer checks over digital payments.

Checks also help when making large payments or donations. Unlike cash, checks provide a written record, making it easier to track money. For those who do not use online banking, checks are a reliable payment method.

Some banks offer special discounts or benefits for check payments. Checks also help people without credit or debit cards make transactions securely.

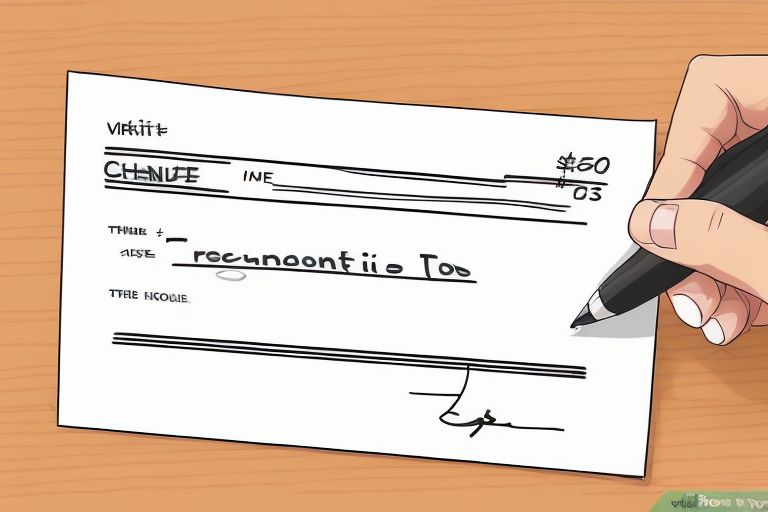

Understanding the Parts of a Check

A check has several important parts, and understanding them makes writing easier. Here are the main sections:

- Date Line – The top right corner, where you write the date.

- Payee Line – The line where you write the recipient’s name.

- Amount Box – A small box where you write the amount in numbers.

- Amount Line – Below the payee line, where you write the amount in words.

- Memo Line – An optional section to write a note or reason for payment.

- Signature Line – The bottom right part where you sign the check.

Learning these parts helps you avoid mistakes when writing a check. It also ensures that the bank can process it correctly.

Step 1: Writing the Date Correctly

Every check needs a date, and it is written at the top right corner. The date tells the bank when the check was issued.

Write the full date, including the month, day, and year. For example, write “March 11, 2025” instead of “3/11/25.” This avoids confusion and prevents fraud.

If you post-date a check, the bank will only process it after the date written. This is helpful for scheduled payments, but not all banks accept post-dated checks.

Step 2: Filling in the Payee Name Properly

The payee is the person or company receiving the money. Write the name clearly on the “Pay to the Order of” line.

If paying a business, use the full legal name. If paying an individual, write their first and last name correctly. Any mistakes can cause problems with cashing the check.

Avoid leaving this line blank. If someone else fills it in, they can cash the check without permission.

Step 3: Writing the Correct Amount in Numbers and Words

Writing the amount correctly is important so banks know exactly how much to pay.

In the small box, write the amount in numbers, like $150.75. Always start from the left side to prevent extra numbers from being added.

On the line below the payee, write the amount in words, like “One hundred fifty and 75/100 dollars.” This prevents tampering and ensures the correct amount is paid.

Step 4: Adding a Memo (Optional, But Useful!)

The memo line is not required, but it can help track payments.

You can write details like “March rent payment” or “Birthday gift for Sarah.” This helps the recipient understand why they received the check.

If paying a bill, write the account number for easy processing. Businesses often require memos for record-keeping.

Step 5: Signing the Check to Make It Valid

A check is not valid without a signature. Sign your name at the bottom right corner exactly as it appears on your bank account.

A missing signature means the check cannot be processed. If your signature does not match the one on file, the bank may reject the check.

Avoid signing blank checks. This prevents fraud and unauthorized payments.

Common Mistakes to Avoid When Writing a Check

Many people make mistakes when writing checks. Here are some common errors:

- Wrong Payee Name – Double-check spelling to prevent issues.

- Incorrect Amount – Numbers and words must match.

- Forgetting to Sign – Banks will not accept unsigned checks.

- Post-Dating Issues – Some banks process checks immediately, even if post-dated.

- Leaving Space in Amount Box – Always start writing from the left to avoid extra numbers being added.

Avoiding these mistakes makes sure your check is processed without problems.

How to Void a Check If You Make a Mistake

If you make a mistake, do not throw the check away. Instead, void it properly.

- Write “VOID” in large letters across the check.

- Do not cover important details like the account number.

- Keep the voided check or shred it for security.

Voiding a check prevents someone else from using it. It is also useful for setting up direct deposit payments.

How to Keep Your Checks Safe from Fraud

Check fraud is common, but you can protect yourself with these tips:

- Keep your checkbook in a safe place.

- Use a pen with permanent ink so details cannot be erased.

- Never sign a blank check.

- Monitor your bank account for any unauthorized transactions.

- Shred old checks before throwing them away.

Taking these steps helps keep your money and personal information safe.

What to Do After Writing a Check? Important Final Steps

After writing a check, follow these final steps to avoid issues:

- Record the check details in your checkbook.

- Keep track of your balance to prevent overdrawing.

- Give the check directly to the recipient or mail it securely.

- Monitor your bank account to confirm when it is cashed.

These steps ensure smooth transactions and prevent banking errors.

Alternatives to Writing a Check: Digital Payment Options

Many people prefer digital payments instead of checks. Some popular options include:

- Bank Transfers – Send money directly between accounts.

- Mobile Payment Apps – Use apps like PayPal, Venmo, or Cash App.

- Credit/Debit Cards – Secure and fast payments.

- Online Bill Pay – Pay bills through your bank’s website.

Digital payments are faster, but checks are still useful for certain transactions.

Conclusion

Writing a check is easy once you understand the steps. Always fill in the details correctly to avoid mistakes. A properly written check ensures your money reaches the right person safely.

Even though digital payments are popular, checks are still important. Learning how to write one can help in many situations. Keep your checks secure and follow banking rules to stay safe.

FAQs

Q: Can I write a check with a pencil?

A: No, always use a pen so the check cannot be erased or changed.

Q: What happens if I forget to sign my check?

A: The bank will not process an unsigned check, so you will need to sign it before using it.

Q: Can I post-date a check?

A: Yes, but some banks may process it before the date, so check with your bank first.